Aura Finance: Chakra Alignment (February 13, 2023)

Meditators, welcome to our 3rd Chakra Alignment update for 2023. Aura Finance continues to build new partnerships, new innovations and, most importantly, continues to attract greater TVL and veBAL ownership.

The Liquid Staking narrative remains pervasive across DeFi as the Shanghai upgrade, scheduled for March 2023 draws nearer. About 14% of all ETH are currently staked, accounting for 16 million tokens and a current value of over $26 billion. Such enormous numbers will continue to drive increased investment, volatility and interest in the space as this capital is freed up to be used across Defi.

Aura continues to amass veBAL, continues to build and continues along the path of de-centralization. Sit, find a nice spot on your favorite couch, relax and let’s align our Chakras!

News

Key Stats: (with changes since last newsletter)

- Total Value Locked $0.5B - (Increase of $40M)

- Percentage of veBAL controlled: 24.92% - (Increase of 0.6%)

- Total vote locked Aura: 13.18 M - (Increase of approximately 300K)

Top 3 Incentives providers for vote locked Aura in the latest round were:

- 1st: Rocket Pool's rETH/WETH w/ $89K rewards allocated at 14.24%

- 2nd: Stargate Finance’s 50/50 bb-a-USD/STG w/ $84K rewards allocated at 13.81%

- 3rd: 50/50 AURA/WETH w/ $80K rewards allocated at 13.48%

The LSD Narrative ongoing updates

The Shanghai upgrade, EIP-4895, continues to loom large in the world of Defi. Balancer remains a leader in staking solutions for many of the key protocols with Liquid Staking Derivatives and Aura Finance remains the best place to optimize yields on those same LSD. For every protocol in this space, the goal is to boost APY for LPs, promote deep liquidity and improve the capital efficiency of providing liquidity to Liquid Staking assets.

Simple facts such as these have led to a surge in new entrants and new pools being whitelisted and added to Balancer and Aura Finance. Some notable recent entrants include Ankr, Stader Labs (planning on releasing their ETHx), Across protocol, StaFi and Coinbase, who join Lido, Rocket Pool and Frax amongst others in maximizing their liquidity and their yields using Aura Finance. Aura Finance supports all of these LSD options and interested protocols are seeking to incentivize their pools and/ or accumulate Aura tokens in a manner that is both systematic and very supportive of a healthy ecosystem.

To stay up to date on the latest developments in ETH stakers, LSD numbers locked ETH percentages, head over to our friends at defiWars to get the facts and figures. https://www.defiwars.xyz/wars/eth

Ankr staking

Ankr protocol have made their first incentive play on Hidden Hand marketplace for vote locked Aura voters. This play is designed to demonstrate their commitment to building up their liquidity depth for their new staked ETH derivative, ankrETH.

Staking Finance (StaFi)

Staking Finance, (StaFi) have entered the LSD wars with their proposed Balancer pool! StaFi Hub is built using the Cosmos-SDK and aims to provide liquid staking solutions for assets through the Inter-Blockchain Communication (IBC) Protocol to rapidly grow the staking industry. Please note, the rETH/ETH pool that is being discussed is a different token to the Rocket Pool Eth (rETH) LSD.

Synapse Protocol

Aura welcomes Synapse Protocol who have recently announced their intention to incentivize deep liquidity through Aura Finance.

Synapse is a cross-chain communications protocol that enables the transfer of reserve assets (stablecoins, ether) and their partner assets (such as gOHM, VSTA, GMX, etc.) across a number of EVM and non-EVM compatible chains. Synapse has a native governance token SYN, which is distributed to liquidity providers and will be incentivized in their new SYN/ETH pool!

Olympus DAO

In our last Chakra alignment update we spoke about OHM voting on how much of their POL they intended to allocate to Balancer Pools on Aura Finance. The final vote came in and OHM will be seeking to add $70M worth of their POL in OHM/ETH and OHM/Dai. This is coupled with our previously announced intention to accumulate over $1M worth of aura tokens to incentivize those pools.

The Migration

After considerable discussion and a follow on vote on Balancer regarding BIP 161 and closing the 2 year funding gap, the great gauge migration is upon us. As a reminder many of Balancer’s current pools are no longer paying protocol fees but are otherwise completely safe - all fees are simply going to LP’s. This migration will allow for these fees to be split between Balancer and veBAL holders in a manner that drives long term ecosystem health.

The first wave of migrations represents some of the higher priority pools and more will follow in at least one more wave to come. There will be two groups of transactions - group A will add the new gauges to the system and be executed immediately. Group B will kill the gauges for the existing pools and will be executed approximately on March 7th. This is to allow time for the next Aura voting cycle to complete to ensure any protocols providing voting incentives get the full value of those incentives. Notably Balancer will only be killing gauges on Ethereum pools in this wave. The first pools to be migrated will be:

- wstETH/sfrxETH/rETH

- rETH/RPL

- BADGER/rETH

- LDO/wstETH

- ACX/wstETH

- wstETH/bbaUSD

- TEMPLE/bbaUSD

- rETH/bbaUSD

- DOLA/bbaUSD

Note: Pools containing bbaUSD will transition to using bbeUSD (Boosted Euler USD). Balancer is awaiting Aave v3 static aToken wrappers to deploy bbaUSD.

Aura Merchandise Giveaway

If you missed out on our last Aura Finance merchandise giveaway then you are in luck. To be eligible to win the next batch of merchandise you will need to:

- Vote, develop, work via grant or mint/stake auraBAL before Feb. 28th

- RT the latest Aura Merchandise Tweet

- Fill out your shipping details here: https://forms.gle/ySjcVhmntQq5BxfL8

Aura will DM you on March 1st if you’ve won (Shipping fee is not included)

Sturdy Finance

Our partners at Sturdy Finance have recently launched a leveraged ETH LP option to maximize yields on staked ETH. They have started with a Convex stETH pool with plans to deploy an Aura pool soon. We look forward to seeing the Aura pool!

Aura Forum Discussions

The are currently 2 very interesting discussions happening on the Aura Finance Forum page. The first concerns ideas, ways and means of accumulating more veBAL in the form of auraBAL to promote the long term health of Aura Finance. The second proposal discusses the idea of using a bonding mechanic to allow for treasury swaps using Bal tokens and Aura tokens. Both ideas are focused on getting more veBAL captured and will benefit from more great discussions on how best to get the ball rolling.

Head over to the Aura forum to participate: https://forum.aura.finance/

Astrolab

Aura Finance’s partners at Astrolab Finance are continuing to build and develop and are rapidly approaching their launch. Astrolab’s latest updates indicate well over 200K Aura accumulated with integrations using Sturdy Finance and others on the way.

Updates like this are designed to keep us in the community conversant with the Aura related developments our partners are making. If you would like your Aura partner protocol updates included in the Chakra series then be sure to reach out!

We continue to see some very interesting and educational content on Twitter regarding Aura Finance. As the Liquid Staking Derivatives (LSD) narrative continues to evolve, the quality of the content and the ideas expressed continues to grow and to inform an ever larger audience.

Our Tweet of the Week:

Defi Queen ( 💙, 🧡 ) @VanessaDefi. The Defi Queen’s recent thread on the Liquidity Staking play and some of her thoughts on some worthwhile plays in the near future, was very informative. The thread covers the basics of Proof of Stake, explains the mechanisms behind it, discusses all things LSD and then covers off on some of the best plays and tokens related to this meta-narrative. With such a detailed thread, there is no surprise that Aura Finance features heavily in the analysis.

19/ Catalyst to watch out for on $AURA

— Defi Queen ( 💙, 🧡 ) (@VanessaDefi) February 6, 2023

~ LSD narrative

~ Partnerships with projects

~$OHM will vote on moving $65M of liquidity into @AuraFinance.

Massive win for $AURA if it passes and would add 10-15% to $AURA TVL.

0xiandao.eth @iandaog recent thread covers some interesting ideas regarding the staking wars and where they plan to allocate capital. While the growth of the Frax staking pool is very interesting, 0xiandao.eth would prefer to focus on yield aggregators, especially Aura Finance.

Guess who else is working with Aura for the LSD narrativehttps://t.co/fW1Xp2AWS1

— BlueLasagna.V2 (@BlueLasagna0x) February 9, 2023

pierreyves.eth @pierreyvesg7, from Notional Finance, thread covers the returns expected within a LSD ETH pool using Notional Finance and their leveraged vaults. If you are interested in this narrative, then it is well worth your time to read up on how leveraged plays and fees contribute to this space.

The Notional @Balancer @AuraFinance wstETH/WETH vault is now at full capacity. This is a clear sign of product market fit.

— pierreyves.eth (@pierreyvesg7) February 9, 2023

No incentives. Just real demand from borrowers to do something productive with their borrowed ETH.

A few thoughts on leveraged vaults👇 pic.twitter.com/PrsSM117gT

TheBit Research @TheBitResearch recent thread on the top 5 safe plays to get yield on your staked ETH before the Shanghai upgrade covered some very interesting protocols and ideas. Top of the list was, not surprisingly, Aura Finance.

1- @AuraFinance

— TheBit Research (@TheBitResearch) February 3, 2023

Pool : $rETH - $wETH

Chain: Ethereum mainnet

APY: 10%

Type of yield: aggregation on top of @balancer paid in $BAL, $AURA and swap fees pic.twitter.com/K7REUcVozQ

Blue Collar Blockchain @bluecollarchain thread covers 12 options for how to get the best returns across a range of protocols for your staked ETH. Aura Finance was covered under the Badger/ rETH pool as a worthwhile option with a very high APY. What was not covered were the superior yields available across a wide range of staked ETH options (over 10 different pools with more on the way).

great thread. Can somebody help me understand why swapping stETH to stable is not a risk? what happens if ETH goes up (with that also stETH) and you can't buy the same amount of stETH with your stables anymore and can't recover the full amount of ETH

— Mamba Mentality (@uroskumer) February 11, 2023

Pendle @pendle_fi has recently joined Aura Finance and they are clearly enjoying the ride so far. The LSD pools currently on offer are some of the best in defi with one of their Aura pools in top spot for yields.

The Pendle LSDs are turning up the heat 🔥

— Pendle (@pendle_fi) February 10, 2023

According to @DefiLlama, our #LSD pools offer some of the highest, most consistent APYs on your $ETH.

Our new Aura stETH-WETH pool currently leads the pack at 37.24% APY🚀

🔹Zero IL

🔹Single-sided LP available pic.twitter.com/fkw61zUURu

@rektfoodfarmer. We saw your recent Token Wars video on Youtube and some interesting tweets from you lately. Noting you had such success with Convex, can we kindly suggest you take a look at Aura Finance.

YouTube

YouTube is the home of longer form content for Aura Finance, especially for news and updates. Whilst Aura has been mentioned in passing in a lot of “read aloud’ crypto videos or trading short videos, there remains a lot of scope for content creators to get involved and create some quality Aura related content.

A recent video from InsurAce, covers how to insure Aura Smart contracts on their platform. Watch the quick tutorial here:

Dune dashboards and Analytics:

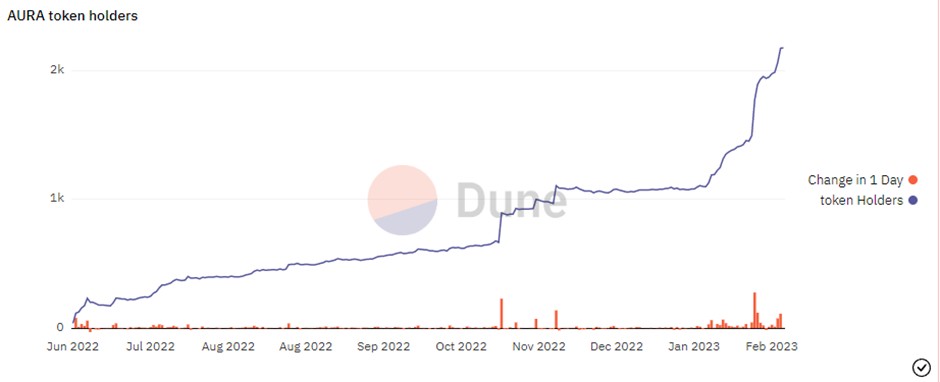

Aura Token holder numbers increase

In a clear indication of the increased awareness and interest in Aura Finance, we can see in the chart below the near doubling of active token holders over the past month or so.

Over 2K holders are now officially joining the Meditator ranks!

Aura Finance was also listed by CoinGecko as a trending token recently due to ongoing searches and views from interested parties. This is likely due to greater exposure as a result of the LSD debates currently raging on Crypto Twitter.

Ecosystem Governance

To get the latest on Aura governance updates head over to the Aura Discord and be sure to follow Aura Finance on twitter.

Disclaimer

The Chakra Alignment series is not official Aura correspondence and is written by community members.