Aura Finance: Chakra Alignment (17 June 2023)

Meditators, welcome to the latest Chakra Alignment Newsletter. A lot has happened since our last letter, with the U.S. regulations agency going after some major Centralized Exchanges. That had an effect on the market, with current prices at a lower level than in mid-May.

While this gives us time to focus and meditate, it is in times like this that BUIDLers build. Aura Finance continues its path of constructing partnerships and innovations to attract greater veBAL ownership for the Meditators’ benefit.

In the last ~30 days, BUIDLers kept building: New steps in the upcoming Arbitrum deployment were successfully completed; An Aura Governance Proposal to improve the efficiency of voting incentives passed; Aura crossed the 30% mark on veBAL locked in the protocol. This, and the other topics we cover in this letter, means a better positioning to get new partners interested in the liquidity Aura can provide.

While this gives us time to focus and meditate, it is in times like this that BUIDLers build. Aura Finance continues its path of constructing partnerships and innovations to attract greater veBAL ownership for the Meditators’ benefit.

It’s time to take a deep breath and prepare to align your Chakras as you go through the 9th Chakra Alignment.

Key Stats:

Total Value Locked $0.48B

Percentage of veBAL controlled: 31.88% - (an increase of over 2%)

Total vote-locked Aura: 18.8M - (2.3M increase!)

Top 3 Incentives providers for vote-locked Aura

🥇 Rocket Pool’s MetaStable rETH/WETH w/ $94.7K rewards allocated

🥈 Stargate’s STG/bb-a-USD w/ $44.3K rewards allocated

🥉Synapse’s 50/50 SYN/WETH w/ $38.7K rewards allocated

News

Aura now holds over 31% of veBAL share.

Controlling >73,000 of the bi-weekly $BAL emissions and increased gauge boosts, emissions and increased gauge boosts, Aura is able to help more protocols deepen liquidity and increase participation in the vlAURA markets.

@JonesDAO_io Compounder crossed the 1M mark in TVL!

https://twitter.com/AuraFinance/status/1661039284915257345

@raft_fi new liquidity pool on @balancer leverages voting incentives on Aura to boost the yield performance!

https://twitter.com/AuraFinance/status/1669375242580684801

AIP-26 is already in action!

https://twitter.com/Paladin_vote/status/1661733879429079040

LSTs finding their home in the Balancer Ecosystem

Balancer is successfully positioning itself as the natural destination for LST liquidity, and Aura has helped to integrate and grow numerous LST protocols such as @swellnetworkio, @BifrostFinance, @Stafi_Protocol, @Tranchess, @ankr, and @unsheth_xyz.

https://twitter.com/AuraFinance/status/1669374285448871938

DeFi Protocols are discovering the power of ve8020!

More and more protocols are redesigning their tokenomics to leverage the power of Balancer’s ve8020 pools. @AlchemixFi, @Paraswap, @unsheth_xyz, and @RDNTCapital are a few examples. Moving away from single staking their governance tokens, now these projects can incentivize liquidity in an optimized way.

https://twitter.com/AuraFinance/status/1661764217882673159

Arbitrum expansion plans are being executed according to the plan 😻

https://twitter.com/AuraFinance/status/1669736603558768645

Composability FTW! @lucid_fi uses Aura as one of the options to mint DUSD

https://twitter.com/lucid_fi/status/1668686942777556993

@pujeetmanot showing the power of one of the new pools deployed in the last week!

https://twitter.com/pujeetmanot/status/1668594868464103428

A how-to from @blockchainismidto shows swETH holders they can boost their APY with Aura.

https://twitter.com/blockchainismid/status/1660969782202732544

@BaoCommunity stable pool debuted on Aura.

https://twitter.com/BaoCommunity/status/1661971397256835075

@Jasper_ETH sharing the good news! @SturdyFinance will enable looping on the rETH/ETH on Aura to boost the deposit APY.

https://twitter.com/Jasper_ETH/status/1659672148783276033

A historical APR chart shared by @HubertX13 shows the improved results of vlAURA!

https://twitter.com/HubertX13/status/1660978537338216457

A Brand new dashboard for Aura coming from @Xeonusify

https://twitter.com/Xeonusify/status/1664607212168179715

A gud thread about Aura from @YTWOFUND highlights the last developments in the ecosystem.

https://twitter.com/YTWOFUND/status/1662067259878113281

The @BifrostFinance pool launch on Aura as viewed by @ThomasR_SupDup

https://twitter.com/ThomasR_SupDup/status/1662098989490028546

Governance - Approved AIPs

[AIP-26] Optimize AURA/ETH and AuraBAL Stable Incentives to Maximize Protocol Benefit

Aura DAO incentivizes both the auraBAL Stable and the AURA/ETH pools through voting incentives on Hidden Hand's veBAL and vlAURA market. However, due to the decreasing efficiency of these markets, it is no longer practical to always allocate to Hidden Hand to incentivize these pools. To ensure stable yields and reduce net emissions, Aura DAO can explore alternative methods to incentivize these pools and optimize efficiency.

[AIP-27] Implement Weighted Voting for Aura

This AIP sought to adopt proportional voting, where votes cast on Aura Snapshot will be carried through proportionally on Balancer. If the voting proposal on Aura Snapshot space is, for example, 30% “For” and 70% “Against”, Aura will cast a vote in the Balancer snapshot space with the very same proportions and using all of Aura’s voting power. This AIP will also introduce an “abstain” voting option, which will be counted in weighted votes.

Balancer’s Snapshot is currently set to “Single Choice Voting,” so a voter can only assign votes to one option. BIP-300 2 shall change this to a weighted system, to facilitate Aura’s move to weighted voting.

[AIP-28] Establishing the Aura Maxi ****

This proposal aimed to establish, fund, and authorize the Aura Maxis as an independent and decentralized service provider (SP) for the Aura Ecosystem.

[AIP-29] Finish migration of Aura pools to optimize integrations & enact AIP-26

In Q1 2023, Aura underwent a proactive security upgrade (AIP-20) to remove certain protected functions in the system that are not necessary and could lead to security issues in the future. The current proposal seeks to migrate 23 pools to the new standard. This proposal was approved and executed with success.

[AIP-30] Introducing Additional Reward Tokens on R/DAI and R/wstETH Pools

This proposal aimed to enhance Raft’s collaboration with Aura. Considering Balancer as its primary hub for liquidity, Raft plans to continue directing significant incentives and efforts to boost liquidity on this platform. Enabling additional rewards on these pools allows Raft the flexibility to customize incentives that extend beyond BAL tokens over the next few weeks.

Dashboards and Analytics

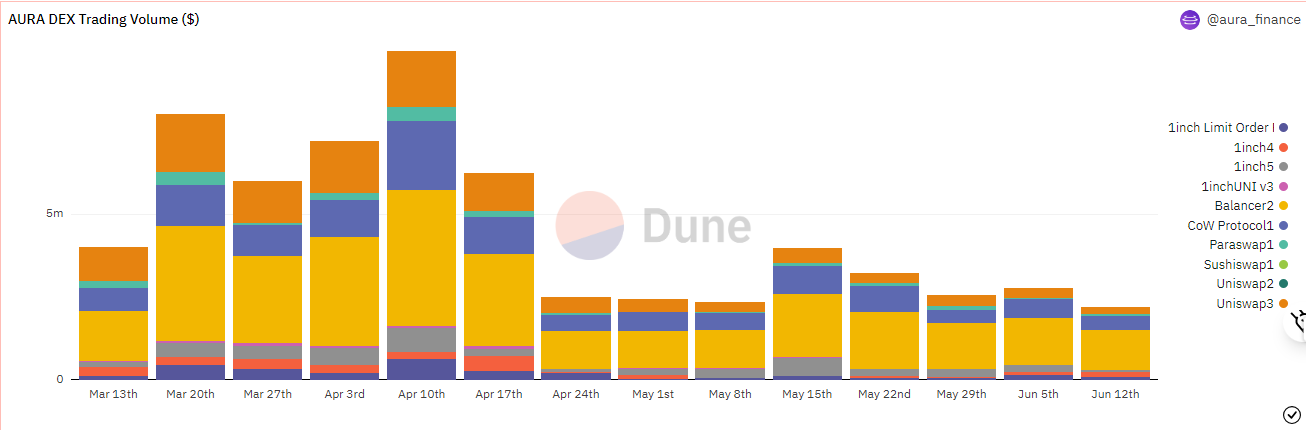

Aura Dex Trades

Source: https://dune.com/aura_finance/aura

Trading volumes remained low for May in Dexes when compared with February/March, and Balancer remains the highest volume.

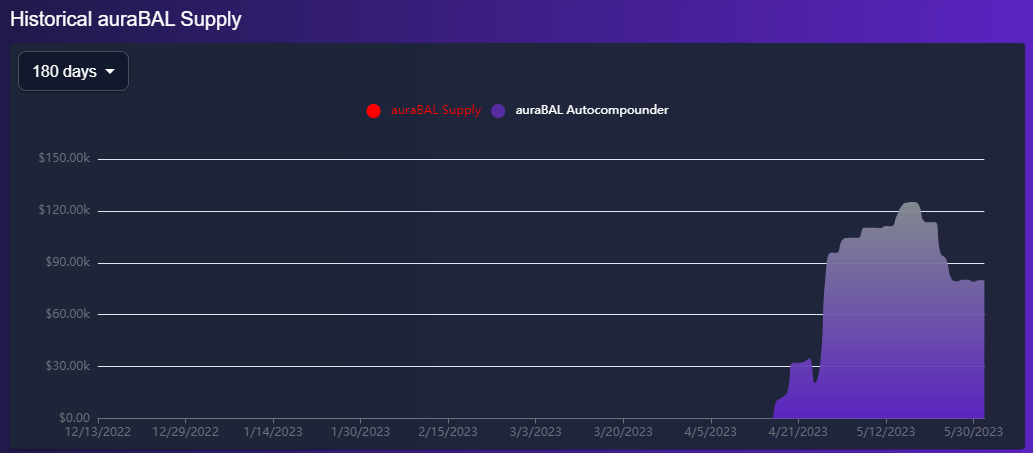

Historical auraBAL Supply - Autocompounder

Ecosystem Governance

To get the latest on Aura governance updates, head over to the Aura Discord and be sure to follow Aura Finance on Twitter.

Disclaimer

The Chakra Alignment series is a community driven newsletter and not official Aura correspondence. This edition has been written James K. from the Aura Maxis.