Aura Finance: Chakra Alignment (15 May 2023)

There is no shortage of newsworthy moments in crypto! Since our last Newsletter, LSD protocols have remained in the spotlight with no sign of cooling down, despite the market conditions fueled by pre-historic BTC wallets coming back to life.

In the midst of this, Aura continued its path to attract more veBAL into the protocol, increasing its share to over 29%. The continuous inflow of partners interested in the liquidity Aura can provide helps to achieve this serene path highly appreciated by the Meditators.

It’s time to focus, take a deep breath, and prepare to align your Chakras we go through the 8th Chakra Alignment.

Key Stats:

- Total Value Locked $0.62B

- Percentage of veBAL controlled: 29.18% - (an increase of around 1%)

- Total vote locked Aura: 16.5M - (1.3M increase!)

Top 3 Incentives providers for vote-locked Aura

🥇 Rocket Pool’s MetaStable rETH/WETH w/ $130K rewards allocated

🥈 Stargate STG/bb-a-USD w/ $88K rewards allocated

🥉Jones DAP 80/20 wjAURA/WETH w/ $60K rewards allocated

News

Over 160,000 auraBAL was minted in April, bringing Aura’s veBAL share to 29%!

With its increasing influence, Aura will continue to grow the Balancer ecosystem by attracting new protocols and TVL.

As Aura's influence and ownership stake in Balancer grows, they will continue to work towards expanding the Balancer ecosystem by attracting new protocols and increasing Total Value Locked (TVL). This growth will benefit Aura and the Balancer community as a whole.

Maybe the first use of AIP-23?

The @OlympusDAO just launched its first Boosted Liquidity Vault with the wstETH/OHM pool!

— Aura (@AuraFinance) April 25, 2023

With AIP-23, Olympus is also able to add additional reward tokens to the gauge.https://t.co/Cv5yFCXUWM

Aura Docs are now in multiple languages!

选择简体中文

— Aura (@AuraFinance) April 30, 2023

한국어 선택

Select any of these options today at https://t.co/PxymYBWdTG pic.twitter.com/MSL73n0iKb

Incentives keep coming…

The @GearboxProtocol proposal to allocate voting incentives has passed!

— Aura (@AuraFinance) April 24, 2023

The protocol will be allocating 1M GEAR to direct emissions to the Gearbox USD Pool every round, potentially adjusting their allocation if the pool grows successfully. pic.twitter.com/JpothbiEGm

Future Deployments: Arbitrum szn is coming

Whilst we don’t have dates set in stone, we saw some of the following announcements for upcoming integrations:

Upcoming integration on @Arbitrum: @0xAcidDAO

— Aura (@AuraFinance) April 19, 2023

Aura will be helping to deepen liquidity for the ACID-ETH pool on Arbitrum.

Stay tuned for more integration releases @AuraFinance pic.twitter.com/QtZboG6Wl9

Upcoming integration on @Arbitrum: @StargateFinance

— Aura (@AuraFinance) April 21, 2023

Aura will be supercharging STG liquidity on Arbitrum by supporting their @Balancer pool!

Stay tuned for more integration releases @AuraFinance pic.twitter.com/Gp1CvWt0vW

Simple as counting from 1 to 10 from @Riley_gmi, Aura flywheel steps in a visual explanation!

https://twitter.com/Riley_gmi/status/1654177478280085539

@swellnetworkio Swel shared their step-by-step guide on how to boost your yield using Aura

https://twitter.com/swellnetworkio/status/1656142877830057985

@yxue14 comes with a good explanation (in Chinese!) about Aura’s inner works

https://twitter.com/yxue14/status/1654420629247119362

Aura was featured in a DeFi protocols list made by the Indonesian @coinvestasi

https://twitter.com/coinvestasi/status/1653726544819531776

When all chakras are aligned, gud things happen, as @smyyguy explains in his tweet.

https://twitter.com/smyyguy/status/1651262141679239168

@FlintLabsHQ presented its list of protocols to keep an eye on, and Aura was there: “With a $700M TVL achieved within a year of launch, it showcases consistent growth in token price and mcap. Solid fundamentals.”

https://twitter.com/FlintLabsHQ/status/1650543938338451456

@OlympusDAO Featured Aura in its most recent “Friends of Olympus: Arbitrum Spotlights”

https://twitter.com/OlympusDAO/status/1656313219508731915

Defi Legos FTW! @pendle_fi + @StaFi_Protocol leveraging on Aura to boost the APY of their pool.

https://twitter.com/pendle_fi/status/1656309832344018954

@defi_naly laying down facts!

https://twitter.com/defi_naly/status/1654177836221988878

Youtube

Trantor posted a video covering delegation and wrapping AURA tokens for small investors, as a strategy to reduce gas costs

Aura Finance - Ideas for smaller holders (part 1)

Governance

AIP 24 - Retain Legal Counsel was approved

Due to the fact that regulations surrounding DAOs are constantly changing and can be unpredictable, Aura DAO has decided to take steps to minimize risk by hiring legal counsel. The DAO wants to ensure that it follows all the laws and regulations while maintaining its decentralized structure. By doing so, the Aura DAO hopes to avoid any negative consequences or penalties that may be imposed on them or their members for non-compliance or illegal activities.

[AIP-25] Approve AURA Liquidity on Arbitrum

Contributors from Aura Finance are working on creating instances of Aura that can function across multiple blockchain networks, beginning with Arbitrum. These instances rely on Balancer's Layer 0 compatible gauge development and, if approved by the Aura Finance community, will allow for AURA liquidity on Layer 2.

To support this effort, Aura Finance proposes a bi-partisan liquidity pool seeding of AURA, ARB, and BAL on Arbitrum, as it has become clear that there is a demand for AURA liquidity there. This proposal is made in collaboration with the Balancer community, who were allocated ~3M ARB tokens as part of the Arbitrum token launch. The Balancer community members have suggested using a portion of this allocation for liquidity on Arbitrum, and Aura Finance would like to propose the creation of an ARB/AURA/BAL pool on Arbitrum. The community will determine the exact weights of the pool.

Dune Dashboards and Analytics

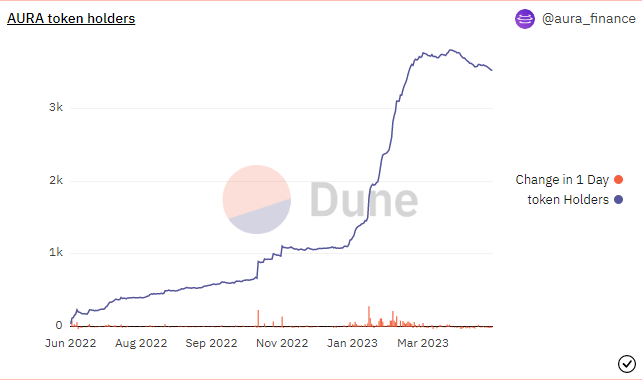

Growth of Aura Token Holders

Source: https://dune.com/aura_finance/aura

We see a decrease in the number of token holders aligned with the market's bearish tone from the last two weeks. It is worth mentioning that this downward momentum was not strong, with low trading volume.

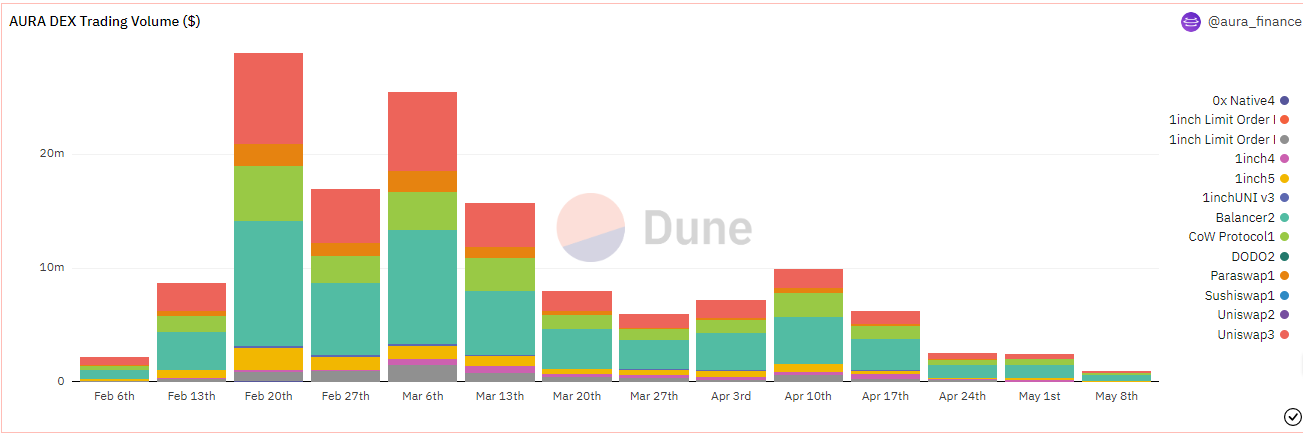

AURA Dex Trades

Source: https://dune.com/aura_finance/aura

Trading volumes are low for AURA in Dexes compared to the buying spree of February/March, and Balancer remains the DEX with the highest volume of AURA.

Ecosystem Governance

To get the latest on Aura governance updates head over to the Aura Discord and be sure to follow Aura Finance on Twitter

Disclaimer

The Chakra Alignment series is not official Aura correspondence and is written by community members. This edition has been written by the Aura Maxis and has been posted by 0xShunbun on behalf of them.