Aura Finance: Chakra Alignment (January 30, 2023)

With 2023 now in full swing and the macro-economic environment remaining as interesting as ever, it is time to align our chakras and contemplate the surrounding ecosystem.

With 2023 in full swing and the macro-economic environment remaining as interesting as ever, it is time to align our chakras and contemplate our surroundings.

New pools and partners are being announced frequently, and the positive energy regarding Aura continues to grow.

The Liquid Staking narrative for Ethereum remains a driving force behind much of the discussion happening on Twitter, and Aura is poised to grow around this burgeoning development.

This newsletter has some of the best analysis from community members we have seen yet, with great quality alpha and interesting ideas for how the entire Shanghai upgrade may play out.

Sit back, relax, and prepare your mind for some high quality updates.

News

Key Stats: (and changes since last newsletter)

- Total Value Locked $476M - (Increase of $70M)

- Percentage of veBAL controlled: 24.29% - (Increase of 0.8%)

- Total vote locked Aura: 12.8 M - (Increase of approximately 0.5%)

The LSD narrative continues

There are plenty of excellent threads and tweets out there explaining what is happening with Liquid Staking Derivatives and where the next big play might go (check out some of the Aura tweets on this in the Twitter section). For those who missed it, the Shanghai upgrade will soon be upon us. This upgrade will allow those who have staked their ETH positions to withdraw them, if they desire, and provides a level of fungibility not previously afforded.

Why is this interesting?

Well it could mean a variety of possible outcomes; however, two of the most likely possibilities are:

- More people feel comfortable depositing into a staking pool because they are now able to withdraw their positions,

- LPs for trading between ETH and staked ETH positions may find attracting deposits more difficult as people prefer directly staking their ETH. This will require staking pools to directly incentivize their LPs to gain deep liquidity and ensure their ongoing participation across DeFi in leveraged markets.

What this could mean is that the LPs which currently exist for staking pools like Frax, Lido, and Rocket Pool, are likely to see more deposits in their single staked pools but less interest in depositing to their LP, as this potentially requires greater incentivization. Alternatively, with increased deposits comes reduced yield, so the LP narrative grows again as people search for yield on staked ETH.

Building on this narrative are protocols like Sturdy Finance, Pendle Finance, Stader Labs, Notional and others, who are poised to enable leveraged staking positions using the actual LPs on Aura Finance as collateral. This interconnected set of possibilities are a direct tail wind to protocols like Aura Finance who have incentivized pools and are integrated with these protocols.

There are currently 10 different LSD products and integrations either already deposited with Aura or seeking to become partners in the coming months.

For example, check out what Notional and Pendle Finance are building during this LSD narrative:

Since the Merge, LSD liquidity on Balancer has grown by over $165M, partially fuelled by new LSD products.

— Aura (@AuraFinance) January 28, 2023

Protocols like Notional & Pendle are leveraging Aura’s LSD utility, Balancer’s flexible AMM, and the increased demand for staked $ETH to launch their own products.

🧵 pic.twitter.com/jqvkPDsDbq

OHM

The Olympus DAO entrance into the Balancer and Aura ecosystem continues to grow. Along with the planned purchase of $1 million of Aura tokens, comes the planned deposit of up to $66 Million of protocol owned liquidity in the Balancer ecosystem. This would allow for OHM to incentivize the OHM/DAI and OHM/ETH pools directly, as they acquire more Balancer and Aura tokens to build out their position. Be on the look out for a vote to deposit either the full $66 Million or a 50% POL position in the coming days.

Inverse Finance and the DOLA pool

After a short hiatus, the DOLA/USDC pool from Inverse Finance is back. With the successful passing of BIP-148, the new pool is back with projected APR at the moment, looking very impressive.

Coinbase

Aura Finance can now be found on Coinbase Wallet. Users can access the dApp directly from their phones or from the web on coinbase.com. Using the rating feature, Aura will benefit greatly from a positive rating from engaged community members.

Stader Labs

Stader Labs DAO are planning to enable the SD/USDC and SD/WETH gauges on Ethereum. This will allow for deeper liquidity for the SD token on ETH, and also prepare the DAO for its upcoming launch of ETHx, its LSD token, in Feb 2023. Another entrant to the LSD space and another entrant to the Aura ecosystem.

ICYMI, @staderlabs DAO is planning to enable SD/USDC and SD/WETH @Balancer Gauges on Ethereum.

— Aura (@AuraFinance) January 21, 2023

This allows for deeper liquidity for its SD token on ETH, and also prepare the DAO for its upcoming launch of ETHx, its LSD token, on Feb 2023.

Vote here: https://t.co/4CbafHqGLg pic.twitter.com/VthNiG1xiv

The Rocket Pool Case Study

Rocket Pool began staking their rETH positions on Balancer and using aura Finance just over 4 months ago and have seen incredible growth in that time. Rocket Pool’s rETH LSD has seen a 400% increase in liquidity on Balancer in that time which has enabled deeper integrations across DeFi. The increased liquidity has also seen an increase in trading activity where on average $2.5m worth of rETH is traded on Balancer everyday, compared with just $350k in the Q3 2022.

Just over 4 months ago, @rocket_pool began to leverage Aura and its sizeable influence over the @balancer eco.

— Aura (@AuraFinance) January 24, 2023

Rocket Pool’s rETH LSD has seen growth (400% increase in liquidity) on Balancer since then, enabling deeper integrations across DeFi.

Let’s take a deeper look 🧵 pic.twitter.com/k6QgMt5Wwr

Delegating vlAURA for Incentives

As a reminder, there are two excellent protocols that vote locked Aura holders can delegate their incentive votes to.

The first is Redacted Cartel's Hidden Hand. Not only does Hidden Hand facilitate the incentive market, they also optimise votes and minimise token spread for small holders. This is especially important to manage gas fees on Mainnet. To check them out head over to https://hiddenhand.finance/aura

The other place to delegate is Paladin. The latest epoch of incentives has seen Paladin produce some impressive returns for those who delegate their vlAURA to them.

To check them out head over to their docs: https://doc.paladin.vote/warden-quest/delegating-your-vote

Ribbon Finance

Ribbon Finance have announced that they are moving their primary source of liquidity from Uni v2 over to Balancer and staking their positions on Aura Finance.

Coupled with their planned incentivization of the RBN/USDC pool it is a great day for Ribbon and for Aura Finance. In line with RGP-30, Ribbon Finance will provide 25,000 RBN bi-weekly as voting incentives for the first two months.

The Ribbon DAO will be migrating liquidity from Uni V2 to the Balancer RBN / USDC Pool on Thursday.

— Ribbon Finance (@ribbonfinance) January 23, 2023

Ribbon will be participating in the @AuraFinance Hidden Hand Market which will incentivize liquidity by rewarding LP's AURA / BAL emissions.

This should improve RBN liquidity 🌊

Legendary NFT

With only a single epoch remaining for the NFT collection, the question on everyone’s mind is whether or not a single Legendary NFT will be minted. There are very few opportunities left to claim one as only a few are up for grabs and the chances are dwindling. Fingers crossed someone strikes it lucky!

Delegating your vote locked Aura

There are 2 different types of delegation within the Aura ecosystem:

Governance and Incentives.

Governance is focused on Balancer proposals, and Aura proposals regarding the structures, operations and workings of the ecosystem. The best place to delegate to support this process is to the Aura Delegate Council. The Aura Delegate Council supports the best interests of the Aura community through discussion, deliberation and active participation in forums and other governance related matters. There is just over 4 million vote locked Aura currently delegated to the council for voting on Balancer and Aura governance proposals.

Incentives are focused on delegating to a different address wherein they vote on your behalf for the allocation of votes and incentives. The most popular place to delegate is Hidden Hand directly, as they optimize returns balanced against available incentivized pools. Paladin are also increasing their presence as a delegation option as per the above.

This newsletter has seen some of the best twitter threads and updates yet. With all eyes focused on the Liquid Staking Derivatives, game, analysis and discussion on CT has been insightful.

Degen Maker @RealDegenGMX has taken out best twitter thread for this Newsletter. With a detailed break down of the key catalysts, the incentives and the opportunities, this thread is a great read. The comments on actually front running the whales this time, are especially interesting as people wake up to the LSD wars.

Will the on-chain liquidity wars start up again?$CVX and $FXS are already pumping thanks to their flywheel effects and LSD narrative.

— Degen Maker (@RealDegenGMX) January 16, 2023

But there's something missing - what about $BAL and $AURA?

Can we frontrun the whales this time around? Let's find out! 🧵👇 pic.twitter.com/NSOeUwdOef

Max Long @myBlockBrain has indicated a place for Aura within the list for max HODL! As your research develops, feel free to reach out to the community on Discord!

Max Long HODL Candidates

— Max Long (@myBlockBrain) January 26, 2023

-@JPEGd_69 $JPEG

-@Level__Finance $LVL

-@CantoPublic $CANTO

-@StargateFinance $STG

-@lyrafinance $LYRA

-@frakt_hq $FRKT

-@neworderDAO $NEWO

-@AuraFinance $AURA

-@CamelotDEX $GRAIL

-@RAILGUN_Project $RAIL

will hawk next few months n select winners

Nick Ford @CryptoWithNick, has released his take on some upcoming Crypto alpha and projects. Aura’s honorable mention in the LSD wars is nice to see. More content and depth here would really help build out Crypto Twitter’s understanding of the LSD wars.

Honorable Mentions

— Nick Ford (@CryptoWithNick) January 26, 2023

7) Treasure ( $MAGIC ) "Decentralized Nintendo"

8) DyDx ( $DYDX) Unlock delayed

9) Aura Finance ( $AURA ) LSDs wars

10) Rollbit ( $RLB ) Crypto casino

11) Synapse ( $SYN ) Top bridge in volume

If you enjoyed this thread, consider hitting the like and RT.

Bully @Vote4Bully is a big fan of the recently released Aura merchandise. The photos look great, maybe Aura needs to do another round of merchandise for the community, hmmmmm???

S/O to @AuraFinance, thanks for the merch! 💜💜💜#Meditator pic.twitter.com/CgvannS5Q5

— Bully (@Vote4Bully) January 24, 2023

Junkie 👁️🐸👁️ @Chainlinkjunkie is connecting the dots. With the LSD wars heating up as Ethereum approaches the Shanghai upgrade, the connected play for many protocols and individuals seeking returns on their Ethereum will be on Aura Finance. We think Aura Finance is more than a “dark horse” in this race!

#LiquidStaking#Ethereum #shanghaiupgrade will bring lots of liquidity to this sector in march time#RocketPool $RPL a big one

— Junkie 👁️🐸👁️ (@Chainlinkjunkie) January 24, 2023

Small#Stakewise $SWISE#Stader $SD

Tiny#SharedStake $SGT

Connected play once the Yield wars start...#AuraFinance #aura

Is my dark horse

D @dayofpiano is seeing the writing on the wall and the possibilities for some seriously interesting yields and incentives in the near future as protocols seek the best positions and the deepest liquidity on their LSD positions.

I bought some $AURA for 2$.

— D (@dayofpiano) January 23, 2023

The Shanghai-upgrade will create a fresh trend of protocols that will benefit from competition among LSD-protocols. In the LSD competition, $AURA will be a huge winner. @AuraFinance

🧵1/2

DeFi Alex @swaggyAlexyo is a stalwart in supporting Aura Finance on twitter. We tend to agree that people are sleeping on Aura Finance, especially with commitments from Olympus and others for big purchases inbound!

People FOMOing into $STG because of the $2mil family office buy…but no fomo pump for @AuraFinance with a $1mil commitment via governance from @OlympusDAO 🤔 some people sleeping and the $aura fomo won’t come till later it seems (probably when another protocol buys in…

— DeFi Alex (@swaggyAlexyo) January 23, 2023

Road2Crypto @CryptoDamus411. Similar in scope and thinking to the thread from Degen maker, this twitter thread is full of detailed analysis and discussions surrounding Aura Finance and the Balancer ecosystem. Check out the reader app that collates the thread (https://threadreaderapp.com/thread/1616103326160158720.html)

Given that the battle for liquidity will be intense, protocols will be fighting hard & spending A LOT of $$$ to get those extra % of yield.

— Road2Crypto (@CryptoDamus411) January 19, 2023

Enter @AuraFinance :

A protocol boosting Defi yield & governance potential, on top of Balancer.

Let me explain:

StakeRocketPool.ETH 🦇🔊🚀 @StakeRocketPool have tweeted out their recent partnership and increased presence in the Aura and Balancer ecosystem. The thread includes an explainer of the rewards and importantly a DIY video on YouTube on how to make a deposit and how to stake using Aura Finance. Links to the video are in the thread.

How to earn (#RealYield +) safely in DeFi just got easier with @AuraFinance combining with @Rocket_Pool ... Jump in the opportunity with us 🧵 /1 https://t.co/BD3mm0sV2s pic.twitter.com/urExGHIRPN

— StakeRocketPool.ETH 🦇🔊🚀 (@StakeRocketPool) January 28, 2023

YouTube

YouTube is the home of longer form content for Aura Finance, especially for news and updates. Whilst Aura has been mentioned in passing in a lot of “read aloud’ crypto videos, there remains a lot of scope for content creators to get involved and create some quality Aura related content.

A recent video from Rocket Pool, covers the rETH staking play using Balancer and Aura and can be found here:

For a great explanation of the entire space check out the Ceazor video linked below or the Aura Helper series which offer step by step guides on how to use Aura Finance.

Dune dashboards and Analytics:

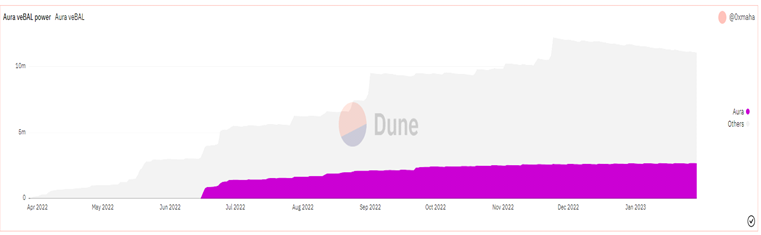

veBAL power held by Aura

The veBAL held by Aura Finance is trending in the right direction. You can check out the growth of the veBAL held by Aura relative to all others:

https://dune.com/queries/915395/1600691

We included this graph in the last newsletter. What can still be seen is the steady increase in AuraBAL over time compared to the decreased total of veBAL locked as a result of the cooling of the BAL wars between Aura and the whale ‘Humpy’. This relative increase continues to work in Aura’s favor!

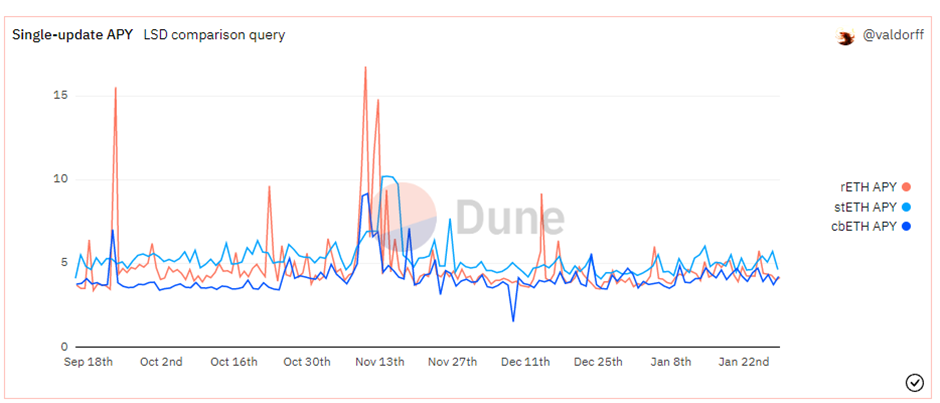

Metrics on Liquid Staking

Yield in single staking with one of the big pools generally returns just under 5% on an annualised basis. With the competition between the biggest providers heating up the search for superior yield continues. As mentioned above the Shanghai upgrade is likely to see some very big changes to these percentages and to the level of participation in these staking pools.

https://dune.com/rp_community/lsd-comparison

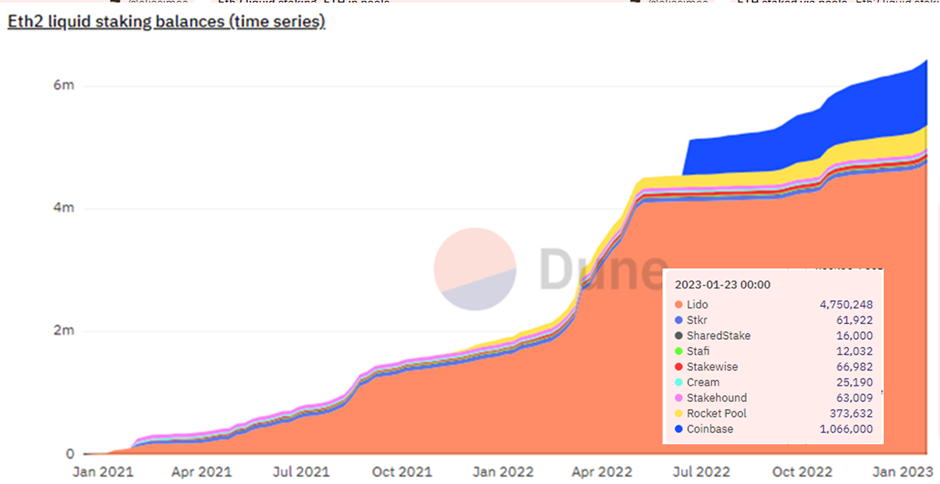

To get a better understanding of the sheer scale of these pools, it is worth considering there are currently 7 Million ETH staked in ETH2 pools with a combined value of over $11 Billion. Lido has well over half of the total staked ETH in these pools and is a big part of the Balancer and Aura ecosystem for the liquidity of their wstETH derivatives. Rocket pool has also rapidly increased its share, along with Coinbase, over the second half of 2022. With so much at stake, pun intended, it is little wonder that Aura is generating significant interest from across DeFi.

Eco-system Governance

To get the latest on Aura governance updates head over to the Aura Discord at http://discord.gg/aurafinance

Disclaimer

The Chakra Alignment series is not official Aura correspondence and is written by a community member.