Aura Finance: Chakra Alignment 28 February 2023

“Visualize your highest self and start showing up as him/her.” Welcome to the 4th Chakra Alignment as we continue the Meditator journey with Aura Finance.

As the Shanghai upgrade is drawing nearer, the Liquid Staking Derivatives narrative is gaining momentum like never before. Crypto markets appear to be waking up, and there is a new sense of purpose and energy everywhere.

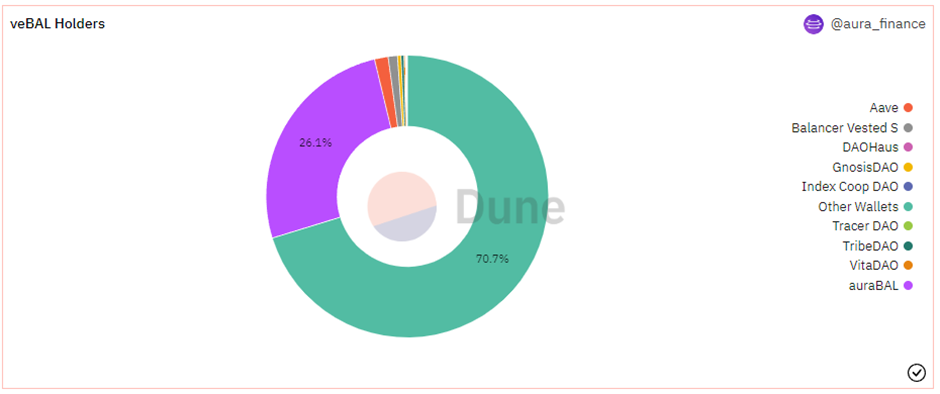

Whether you are drawn to Aura Finance by the impressive veBAL control (now well over a quarter of all veBAL), the Balancer boosted pools narrative, or simply because of price action, you have come to the right place and are welcome to align your Chakras right here with us!

News

Key Stats: (with changes since last newsletter)

- Total Value Locked $0.61B - (Increase of $100M)

- Percentage of veBAL controlled: 26.12% - (increase of 1.2%)

- Total vote locked Aura: 13.6M - (Increase of approximately 400K)

Top 3 Incentives Providers for Vote Locked AURA:

🥇 Stargate 50/50 bb-a-USD/STG w/ $179K rewards allocated

🥈50/50 AURA/WETH w/ $96K rewards allocated

🥉Rocket Pool’s MetaStable rETH/WETH w/ $78K rewards allocated

An AuraBAL Wrapper

The recent Aura Improvement Proposal (AIP 21) aims to strengthen Aura's accumulation of veBAL by creating a new wrapper for auraBAL that has auraBAL and AURA as reward tokens. The wrapper reward contract will use all BAL and bbaUSD earned from the base auraBAL reward pool to market buy auraBAL, maintaining a healthy peg ratio and driving further minting. Fees will be immediately changed from 20.5% to auraBAL, to 18.5% going to auraBAL and a 2% capped platform fee. This 2% will be sent directly to the wrapper as auraBAL to increase the base yield. The additional reward ensures that there is a strong incentive for auraBAL stakers to migrate to the new contract, as rewards will be higher without the need to accumulate or manually sell your BAL and bbaUSD.

This proposal is the culmination of 2 forum discussions that we reported on in the last Chakra Alignment. Thanks to our contributors Fry and Yakitori, we now have a wonderful new proposal that will provide excellent returns to stakers and promote veBAL accumulation for Aura.

The LSD Narrative Continues

There is never a dull moment in the LSD narrative, and the recent moves by the US Securities and Exchange Commission have put further focus on decentralized exchanges and staking options. Kraken's settlement with the SEC and the removal of staking services from other centralized entities have lit a fire under retail and institutional holders looking to stake their ETH.

It appears the big winners would be the LSD protocols who will support the desires of stakers moving forward. As many of you have no doubt read, this is part of the reason why Balancer and Aura have seen such tremendous growth over the past few months. The question remains however, which staking protocols will be the most successful in drawing new deposits to their staking pools. Balancer can now boast of integrations with Rocket Pool, Lido, Frax, Sturdy, Coinbase, Swell, StaFi, Ankr, and many more who are supporting pools built on these LSDs.

Rocket Pool has already demonstrated the power of leveraging Aura Finance and and a simple glance at the LSD market will show the wide array of top protocols and their accumulation of Staked ETH. What is notable here is that every one of these protocols are seeking greater Balancer and Aura exposure to secure their futures as Liquid Staking Pools. https://www.defiwars.xyz/wars

For more discussions on the rise of the LSD narrative, check out Defiant's recent article highlighting Balancer and Aura Finance. https://thedefiant.io/balancer-surges-lsd

Total Value Locked Reaches $600 Million USD

Aura Finance has recently surpassed $600M in TVL thanks to the ongoing support from a range of partners. With supercharged deposits from a variety of LSD protocols and a recent partnership with Olympus, Aura has become the 21st largest DeFi protocol in TVL. This is a significant achievement and sees Aura right on the heels of Sushi!

Alchemix Voting to Acquire AURA

Alchemix protocol has voted on a new strategic plan to acquire AURA (AIP-82-B). A recent announcement from the Alchemix team outlines the plans to revamp ALCX tokenomics by turning it into a revenue generating asset through its ability to influence gauges, earn from protocol revenue, and generate MANA.

As a precursor to the functionality of veALCX, the DAO will transition its liquidity from the current Sushi 50/50 ALCX/ETH pool to a new Balancer 80/20 ALCX/ETH Pool. This will mark the first step on the path towards a revenue-generating ALCX. To achieve this, Alchemix has voted to acquire significant AURA for locking and incentivizing their future pools. This is exciting news from the team at Alchemix and we are looking forward to Alchemix joining the Aura ecosystem.

Rainbow Kit Integration

Aura Finance has recently integrated with the Rainbow wallet app as well as their kit set-up which makes using Aura Finance even easier. Rainbow seeks to make the navigation of Web3 smoother with a user friendly interface, security system and back up system, onboarding new people into crypto and DeFi. This latest integration is another example of the ongoing growth of Aura Finance.

Aura Finance Listing on Token Terminal

Aura Finance is now integrated on Token Terminal. Anyone can monitor protocol metrics like annualized fees and revenue along with daily active users in real time from the Aura terminal. Current integrations includes financial tracking spreadsheets along with current valuations. For further details and analysis, the Token Terminal pro-suite offers more insights.

https://tokenterminal.com/terminal/projects/aura-finance

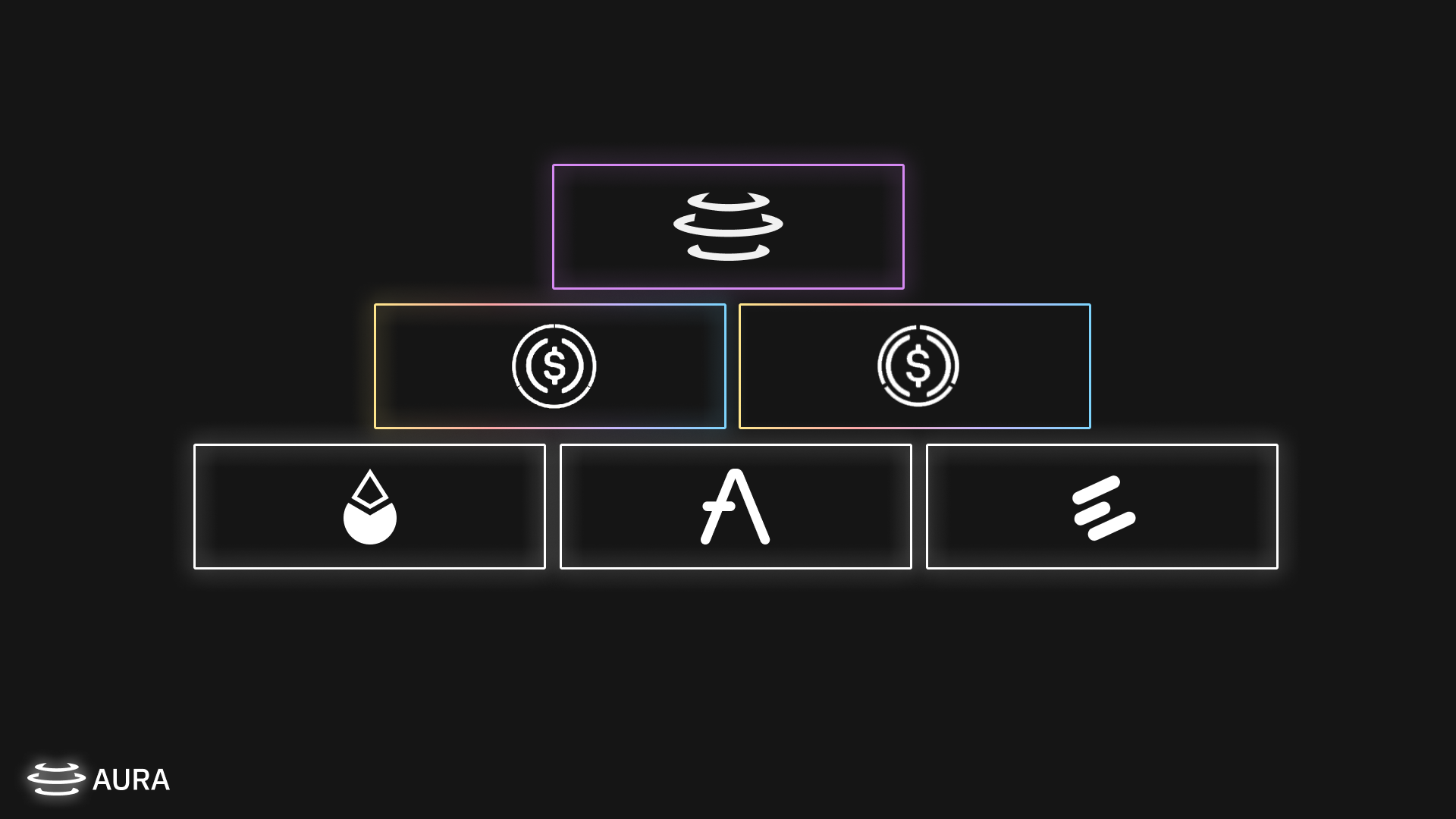

The Importance of Boosted Pools

It can be easy to sometimes forget why the Balancer model has been so successful in the LSD wars. Well, one of the reasons is the success of boosted pools for yield generation. As a quick recap, when it comes to Automated Market Makers (AMMs), only a small percentage of liquidity deposited into a liquidity pool is actually used for trades. Not surprisingly, most of the TVL in a pool is not traded on a daily basis and is simply “sitting there”. Monetizing that liquidity therefore provides an excellent means of increasing capital efficiency whilst maintaining deep liquidity. Boosted pools achieve this by storing the majority of their liquidity on external protocols as yield-bearing versions of common tokens. There are then options for meta-stable pools, core pools and weighted boosted pools to meet the needs of individual protocols. The linear pools themselves, and how the fee structure works, are for more detailed reading with an excellent article recently published here: https://medium.com/balancer-protocol/balancer-launches-defis-next-building-block-with-generalized-boosted-pools-11da07e26fed

Record Week For Incentives With Hidden Hand

For those who delegate their gauge votes to Hidden Hand, this past epoch saw a record number of incentives provided from a variety of protocols. Most notably, this past epoch returned approximately 8c per vote locked Aura token to delegators which is a significant increase over previous epochs.

Paladin and Warlord

Rumors are indicating a brand new product is soon to be released from our partners at Paladin, called Warlord! With further details to be announced in the coming week, from what we understand, it is a vote incentive Index composed of AURA & CVX. The goal is to onboard more people that are less prone to locking tokens on Balancer or Aura (institutions and non-DeFi natives) but who are very keen to participate.

Swell Finance

Swell Finance is entering the LSD battlefield with their new swETH LSD. They are deploying significant liquidity to Aura in the coming weeks. Users will have more options than ever before to gain exposure to the ongoing ETH narrative. The current plan is for a launch of their swETH product in April!

Without a doubt, the buzz across Twitter has revolved around Liquid Staking and this week has seen a continuation of the trend. Protocols are now heavily leaning into Twitter threading to promote their products, providing some very educational content in the process.

Our tweet of the week:

X @xavana0x has published a very detailed thread on the LSD wars and the narrative surrounding Balancer and Aura Finance. Most notably the explanation of why smaller protocols, ie not Lido, will likely need to incentivize their liquidity heavily with Aura Finance to gain market share. It was a very clear explanation of why Aura and Balancer are so well positioned. The links in the thread were also right on point and neatly explained the Balancer advantage in this ongoing LSD gold rush.

1/22

— X (@xavana0x) February 20, 2023

With the imminent launch of Ethereum’s Shanghai upgrade, LSD tokens will likely continue to prove as one of the best narratives of the year.

That being said, I believe the biggest winner coming out of Shanghai will not be an LSD protocol, but rather @AuraFinance. pic.twitter.com/Uf8N1T8Uss

Never🦋 @DefinedNever is linked to the Redacted protocol and this tweet is self explanatory. With record bribe volume, Hidden Hand are justifiably proud of how their incentive market place has developed and the ongoing partnership with Aura Finance.

👥Our @AuraFinance and @balancerlabs markets were the driving force behind this impressive performance.

— never🦋 (@DefinedNever) February 22, 2023

💰Our 4m delegates earned ~$0.08 per vote. Want to join as a delegate? Follow these instructions: https://t.co/TMQpwCBVaC

Swell @swellnetworkio thread covering their planned launch of the swell staked ETH pools is very informative and clearly indicates their desire to launch into the Aura Finance ecosystem. The thread is worth a read to better understand new players, and new integrations for protocols trying to compete in the LSD narrative moving forward.

swETH token- what is it?

— Swell (@swellnetworkio) January 26, 2023

swETH is a transferrable ERC-20 token where Swell provides users with a non custodial means of liquid staking.

swETH increases access to ETH staking by lowering economic threshold requirements.

Here are the 4 important points about swETH 👇🧵 https://t.co/8rXn6faEXc pic.twitter.com/F1iXVn4F9i

Sturdy 🧱 @SturdyFinance have made good on their promised integrations with Aura Finance, with new leveraged staked ETH vaults. Their thread explains how the leveraged deposits work and how best to be involved, along with a brief description of the risks. Of course this is not FA, but understanding this market is useful in understanding the entire space and the LSD narrative.

1/ Strap in. Sturdy is taking LSD yields to new heights with our latest integration!

— Sturdy 🧱 (@SturdyFinance) February 20, 2023

Users can now lever up their @Balancer wstETH/ETH LP for up to 🤯45% APY🤯

Sturdy has partnered with @Balancer and @AuraFinance to offer the best ETH yields in DeFi! pic.twitter.com/9Skc34bF7i

0x6851.lens || (💙,🧡) || ⚙️ || 🌊📘 @0x6851 has the right idea. Aura Finance is certainly worthy of such a position!

If I could only hold three tokens other than stables, they would be $BTRFLY, $AURU and $LVL.

— 0x6851.lens || (💙,🧡) || ⚙️ || 🌊📘 (@0x6851) February 25, 2023

How about you?@redactedcartel @AuraFinance @Level__Finance

The Hook 🪝 @TheHook45 has been asking @rektfoodfarmer the same questions we have. Why no discussion on Aura Finance and the options for yield and farming?

Where’s $AURA? I thought you’d be an $AURA bull. It’s got everything a foodfarmer is looking for. @AuraFinance

— The Hook 🪝 (@TheHook45) February 24, 2023

YouTube

Aura continues to be mentioned in passing in a lot of “read aloud’ crypto videos and/or trading short videos, there remains a lot of scope for content creators to get involved and create some quality Aura-related content.

Encyklopedia Kryptowalut @EKryptowalut has given us a non-English video with plenty of details for our Polish friends. It is wonderful to see non-English content regarding Aura Finance.

Dune Dashboards and Analytics

AuraBAL Growth!

The big news for our latest Chakra Alignment is certainly the increase in Aura controlled veBAL to over 25%! With increased veBAL control comes increased BAL emission control, and in turn greater value being delivered to vlAura holders.

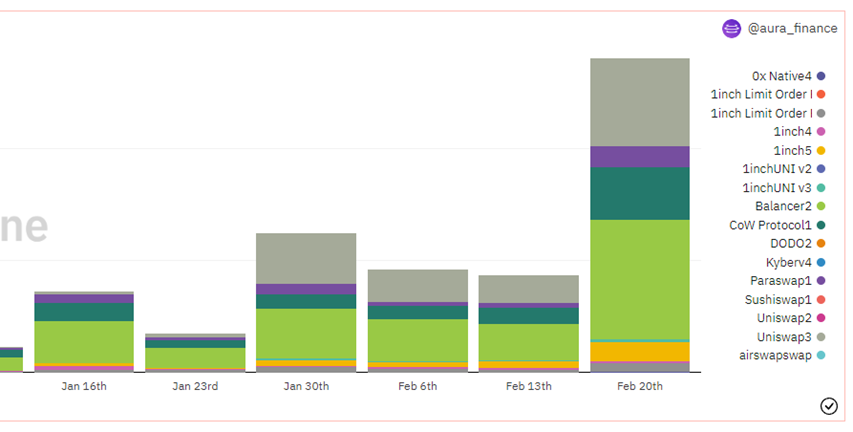

AURA Trading Volumes

Trading volumes as measured by different DEXs, can also be an interesting metric to understand where most of the trading for Aura actually occurs, as opposed to the liquidity. Notably, there is considerable volume on Uniswap and aggregating through 1inch, equaling that of Balancer, where the primary liquidity resides. Future editions of the Chakra Alignment will cover the trading volumes and LP options that exist for the Aura token.

Eco-system Governance

To get the latest on Aura governance updates head over to the Aura Discord and be sure to follow Aura Finance on twitter.

Disclaimer

The Chakra Alignment series is not official Aura correspondence and is written by community members.