Aura Finance: Chakra Alignment (January 16, 2023)

Welcome Meditator, time to relax and take a seat as we align our Chakras and discuss all things Aura Finance.

The ‘Chakra Alignment Series’ will replace the old forum newsletter to allow for more embedding of tweets, greater use of graphs, pictures, AND an even greater use of community generated content. So sit back and relax as you absorb the latest information regarding Aura Finance.

News

Key Stats:

- Total Value Locked $405M

- Percentage of veBAL controlled: 23.5%

- Total vote locked Aura: 12M

OHM

Olympus DAO have passed TAP-17 which has committed them to the purchase of over $1M of AURA over the next 6 months. This is an exciting new partnership that is sure to drive deeper liquidity to the OHM token and to increase the focus and interest on the Aura platform.

The LSD Narrative

The LSD narrative is growing rapidly and the potential for a ‘gold rush’ in staked Ethereum liquidity is very real. As usual, Aura Finance and Balancer are ahead of the curve (pun on partially intended)! The top Liquid Staking Derivative pools for Ethereum have all found a home on Balancer and the Aura App. Large deposits in the Lido, Rocket, Coin Base and now Frax pools, mean Aura is well positioned to build on its role as a leader in providing liquidity and incentives to the LSD space. These primary staking platforms are supported by other partner combinations with LSD assets such as the Badger/rETH pool and the Across/wsETH pool. Aura is very much leaning into this narrative and there will be more threads and info in the coming days and weeks.

Stakewise are currently migrating to their own Version 3 system with interesting new dynamics impacting their $sWISE tokens and insurance for staked ETH positions. As they move towards this new model, Aura Finance can expect some significant incentives from Stake Wise to drive deeper liquidity. Be on the lookout for the launch!

Pendle Finance have recently launched as new partners for Aura Finance and have included the rETH/WETH pool in their options for discounted purchase of ETH tokens. At the time of writing, there is a 5% discount on ETH purchases with a 1-year expiry.

Frax

@fraxfinance is exploring the idea of a boosted FRAX-Aave pool on @Balancer to be supported with incentives for vlAURA holders. This will be coupled with their plans for incentives to the Triple-ETH LSD pool which includes frxETH/rETH/wsETH. This is another huge player in the Balancer ecosystem supported by Aura Finance.

Migration Rewards

The next batch of Aura rewards will be distributed in the coming week from the migration. For more details on this process, please head over to Twitter or Discord.

Legendary NFT

The last 2 weeks have seen an increase in the number of Epic Meditator NFT minted. We are yet to see any of the Legendary NFT minted. At only 0.5% of the total supply we must be getting pretty close to one of these Legendary offerings and we look forward to seeing one on Twitter!

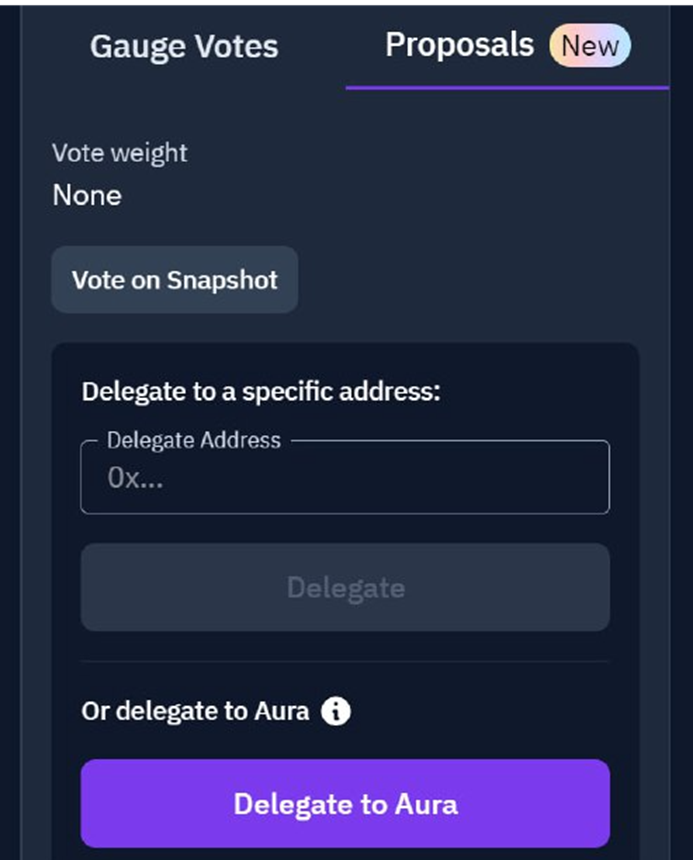

Aura Delegate Council

The Aura Delegate Council continue to vote on Aura and Balancer governance for the protocol and recent announcements have made doing that a lot easier. With the introduction of the new delegation tab on the aura app, vlAURA holders can now split their delegations. Importantly this allows users to delegate to Hidden Hand or to self vote for incentives and to Aura Finance for Governance Proposals.

Be on the lookout for another Aura Helper video in the near future explaining this updated process. An example of what you will see on the app is below:

@OlympusDAO have officially announced the Passing of TAP-17. This proposal will see Olympus acquire $1M worth of AURA over the next 6 months to provide incentives to their pools on Balancer. This is an exciting partnership with a true giant in the crypto space.

Today, the ohmies voted in favor of TAP-17: Aura Acquisition!

— OlympusDAO |Range, Bound| (@OlympusDAO) January 13, 2023

As some yet-to-be unveiled projects undertaken by the DAO are coming to fruition, gaining governance power over the Balancer ecosystem becomes one of the strategic priorities for the Olympus Treasury. pic.twitter.com/OpA0c0Hc6Z

Sweetcheeks (@sweetcheeksreal) makes a great point regarding the ROI for incentive providers on Aura Finance at the moment. With emissions currently sitting at more than 100% above the dollar amounts spent on incentives there are plenty of reasons for interested DAOs and other providers to be seeking to bootstrap their liquidity with Balancer on Aura.

Is @AuraFinance ROI of bribe the highest in the market right now? (for deep liquidity) 2.68$ on the dollar? Or does @VelodromeFi offer a better ROI? pic.twitter.com/CfVikD8g5V

— Sweetcheeks (@SweetcheeksReal) January 14, 2023

@pendle_fi have announced their moves in the ongoing LSD narrative with their Pendle ETH Maxi Arc. This is a story about some serious moves they are making to provide yields to staked ETH.

Every narrative needs a good arc, and every good arc needs a good fellowship.

— Pendle (@pendle_fi) January 12, 2023

Presenting The Pendle ETH Maxi Arc -

Featuring yours truly, alongside @AuraFinance, @Rocket_Pool and @Balancer 🧵 pic.twitter.com/SP5G5z6iXJ

@0xGeeGee has published an interesting thread covering the LSD narrative which includes Aura Finance. As mentioned in the thread, more of a stream of consciousness and thinking out loud together with some excellent insights covering the LSD narrative and the benefits of positions on Aura Finance in the Balancer ecosystem. https://twitter.com/0xGeeGee/status/1613657324505423875

Thinking out loud:

— 0xGeeGee (@0xGeeGee) January 12, 2023

I'm thinking G's favorite coin and @OndoFinance (after tokenomics are known) might be two gud coins for this.

Maybe @RealTPlatform (same as for ondo).

Also maybe @centrifuge via Tinlake. https://t.co/hPN2YxIiV2

BanhMiSwap and wagmiFlip.gg (@WagmiFlip) are also seeing the potential with the recent announcement from OHM that they will be stacking up on Aura tokens in the coming 6 months. Exciting times indeed!

@OlympusDAO is entering the @Balancer wars by picking up $1m worth of @AuraFinance over the next 6 month. @OlympusDAO once proving that they are a core part of the DeFi heartbeat. The future is bright! https://t.co/HWUCHTJwQ2

— BanhMiSwap.gg & wagmiFlip.gg (@WagmiFlip) January 12, 2023

@SiloFinance have provided a great little example of how to use their leveraged vaults for lending and borrowing with Aura. Notably the tweet is designed to help users better understand how the APY is calculated and applied. https://twitter.com/SiloFinance/status/1613389816888193027

Want to see how borrowing affects APY?

— Silo Finance (@SiloFinance) January 12, 2023

Borrow tabs now show APY based on current utilization rates so you can predict how this may change.

You can even input a borrow amount to project APY growth over time!

Try it out on the Aura silo: https://t.co/PEehZ4CEix#SiloTheRisk pic.twitter.com/CR5wGL1Eeu

Defi Alex (@swaggyAlexyo) has rightly pointed out that a bullish stance on the LSD narrative should easily translate into a bullish stance on the Balancer ecosystem and aura in particular. With the best yields on Aura Finance for these LSD positions, why would you go anywhere else.

With the balancer “Boosted MetaStable Pools” technology balancer/aura is the most effective place to earn max yield on LSDs. If you are bullish on this current LSD narrative you should be bullish the balancer ecosystem and @AuraFinance https://t.co/PNE9yrTqcb

— DeFi Alex (@swaggyAlexyo) January 10, 2023

563 (@563defi) has done a very detailed partner thread covering redacted cartel and some of their upcoming products and projects. We are calling this one out, as it clearly highlights the great stuff our partners are doing, even if Aura Finance is only mentioned in passing as an important partner with Redacted cartel using Hidden Hand. A great thread, and some interesting insights.

HIDDEN HAND has already onboarded a bunch of top names, and is working on building a ramp to make the onboarding completely permissionless.

— 563 (@563defi) January 10, 2023

Existing partners: @AuraFinance @Balancer @FloorDAO @fraxfinance @ribbonfinance @TokenReactor @idlefinance @saddlefinance

@fiatdao have announced the rollout of collateral support for bb-a-usd principal tokens from @element_fi. It represents deposits into the @iearnfinance vault that auto-compounds Aura Finance positions in the Balancer pool.

We're also happy to announce the rollout of collateral support for bb-a-usd principal tokens from @element_fi.

— FIAT DAO (@fiatdao) January 10, 2023

It represents deposits into the @iearnfinance vault that auto-compounds @AuraFinance positions in the eponymous @Balancer pool. https://t.co/HC7nAcs5S3

@FroyoFren on the hand, is dropping some alpha regarding the LSD wars and their thoughts regarding post-Shanghai updates. Do you think they're on to something?

Debated if I should share alpha, but here it is.

— Ice v3 (@FroyoFren) January 15, 2023

Working thesis for massive LSD beta:

Shanghai and resulting ETH withdrawals are rocket fuel for $AURA and $CVX.

They benefit exponentially from competition between $LDO $SWISE $SD $RPL and more.

In a war, sell the swords. pic.twitter.com/IHhO2zEmvm

@koheingt has announced the creation of the delegate lists which catalogue some of the key delegates across a number of important platforms. Not surprisingly Aura sits right there in the top 2 for delegates on the Balancer ecosystem for voting. With great power comes great responsibility!

6/ Delegats at @Balancer

— kohei.eth ☂️ (@koheingt) January 9, 2023

List of top 8 delegates

- @0xSolarcurve

- @AuraFinance

- @llama

- @cianfru

- @The_Krake

- @Zen__Dragon

- @Xeonusify

- @stablelab pic.twitter.com/dA7E65IxtI

@flywheelfi has shared a very short video clip from a Frax participant which talks to the planned launch of the Liquid Staking Derivatives pool on Balancer and Aura Finance. The idea being that a rising tide lifts all boats, Frax’s entry into the staking pool market is both interesting and exciting for the entire LSD narrative.

Frax’s motto has always been “Stronger Together”, and on our latest pod @samkazemian reveals their plans to support @Balancer’s ETH LSD pool through incentives on @AuraFinance 🫡

— Flywheel (@flywheelfi) November 28, 2022

🎥 https://t.co/s6ZKChpSjo pic.twitter.com/LCRGI7KNqw

@rektfoodfarmer has had a lively discussion with @0xfrundles about places to stake ETH if you are not running your own validator node. We tend to agree with your audience that Aura Finance is a very popular place to stake your ETH derivatives for excellent returns.

I try spread my risk out a little and earn between 6-12% yield

— 0xFrundles (@0xfrundles) January 9, 2023

- vanilla validators (~40%) @ ~5-6%

- $RPL validators (~10%) @ ~7-9%

- @fraxfinance frxETH/ETH Convex pool (~15%) @ ~11-12%

- @AuraFinance wstETH/sfrxETH/rETH pool (~15%) @ ~10%

For some more of our non-English language content check out the latest deep dive and explainer in Vietnamese at https://danchoitienao.com/aura-finance-la-gi/ . Handily the google translate on this one works pretty darn well and the content looks great for explaining who and what Aura finance is all about.

YouTube

YouTube is the home of longer form content for Aura Finance, especially for news and updates.

Trantor has completed a December 2022 and 2023 update video covering the latest goings on. The video covers market updates, partner protocols and short round up of the Balancer Wars.

Check it out: https://youtu.be/Di4IDSE2FFg and please leave a comment!

We also have a read out video from Mega Crypto which covers off on Aura Finance https://www.youtube.com/watch?v=RwhXkyEmjPA

More videos are surfacing everyday that cover the LSD narrative and DeFi plays. Keep an eye out for commentary on Aura finance and be sure to tag them for inclusion in the Chakra Alignment.

Dune Dashboards and Analytics:

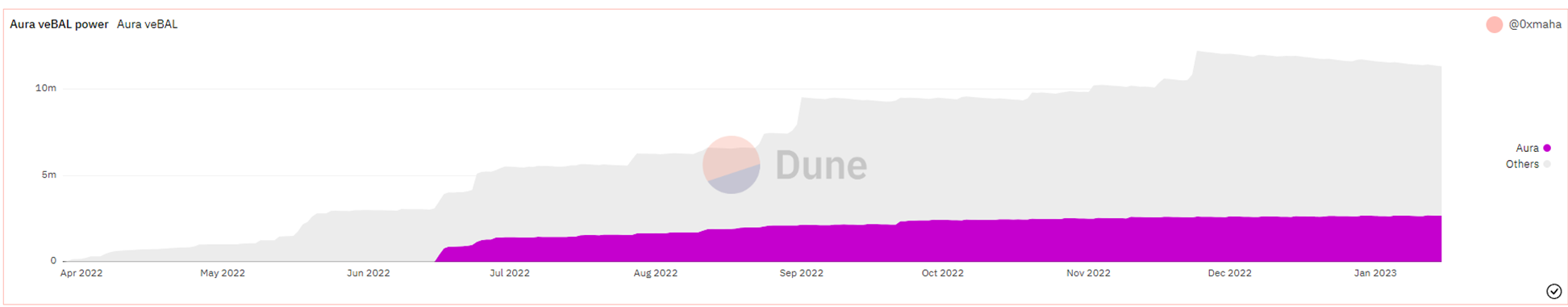

veBAL power held by Aura

The veBAL held by Aura Finance is trending in the right direction. You can check out the growth of the veBAL held by Aura relative to all others here: https://dune.com/queries/915395/1600691

What this graph highlights is since the peace treaty the total amount of veBAL held by non-Aura holders has declined by about 900,00 whilst the Aura total has steadily increased. This is important for understanding relative percentages but also for understanding where the unlocked veBAL may indeed go in the near future….. potentially across to AuraBAL

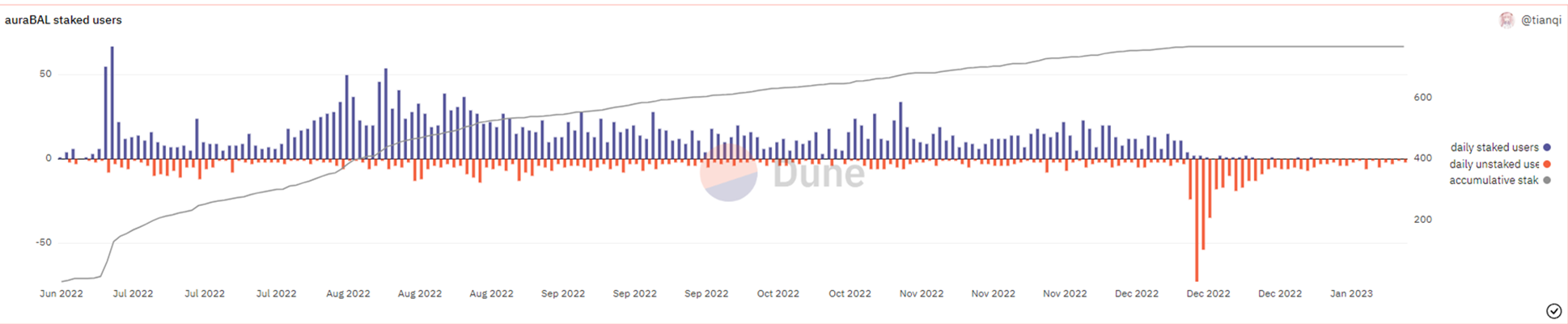

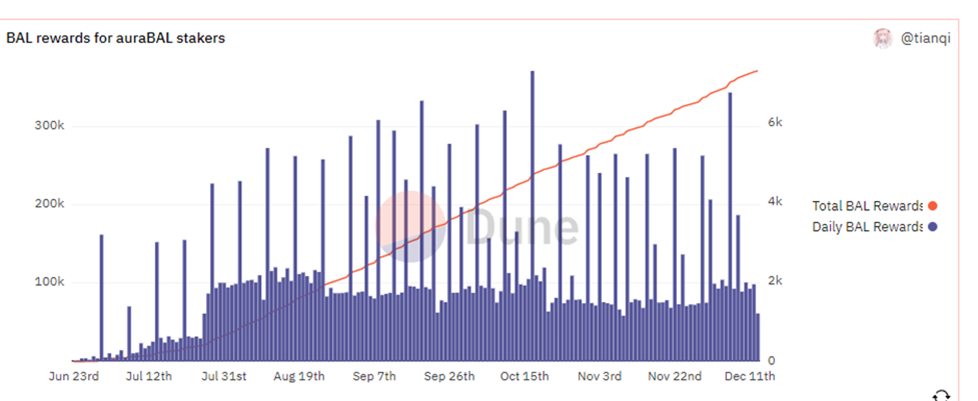

auraBAL rewards and staked amounts

A recent recipient of the AEF grant committee, Tian. has also created a dashboard which provides some insights into the amount of auraBAL staked. Notably, there was a sharp decrease in the amount of staked auraBAL in December which has in turn seen a sharp rise in the number of BAL per auraBAL emitted as rewards. This helps to explain some of the increases seen in the percentages awarded to auraBAL stakers which currently sits at around 50%. https://dune.com/tianqi/aurabal-staking

and

Ecosystem Governance

To get the latest on Aura governance updates head over to the Aura Discord and track the channel ‘Governance Updates’.

Disclaimer

This newsletter does not constitute official Aura correspondence and is written by community members.