Aura Finance: Chakra Alignment (March 14, 2023)

We are covering auraBAL's recent growth, the upcoming Balancer & Aura’s cross-chain era, Olympus' continued Aura accumulation, and exciting partnerships ahead!

GM Meditators - a lot of updates for today's 5th Chakra Alignment!

We are covering auraBAL's recent growth, the upcoming Balancer & Aura’s cross-chain era, Olympus' continued Aura accumulation, and exciting partnerships with Synapse Protocol and Redacted Cartel's Hidden Hand.

So while the Shanghai upgrade is drawing closer and Aura continues in its LSD narrative, Aura is notably working hard on its auraBAL compounder and preparing itself for Balancer's push towards major blockchains.

Let's get those chakras aligned!

News

Key Stats: (comparing the changes since the last newsletter)

- Total Value Locked $0.65B - (Increase of $40M)

- Percentage of veBAL controlled: 27.22% - (increase of 1.1%)

- Total vote locked Aura: 13.8M - (Increase of approximately 200K)

Top 3 Incentives Providers for Vote Locked AURA:

- 🥇 50/50 AURA/WETH

- 🥈 Olympus' 50/50 OHM/WETH

- 🥉Rocket Pool’s MetaStable rETH/WETH

The auraBAL Wrapper And Its Recent Growth

In the early days of Aura, it was practical for Meditators to stake veBAL with Aura to receive auraBAL, as well as LPs who can deposit liquidity and receive Aura LP tokens. Compared to staking alone, auraBAL stakers could now accumulate more rewards than holding veBAL, while LPs enjoy boosted emissions.

With the growth and popularity of Aura, other protocols started to notice its influencer in the Balancer ecosystem and would send incentives to vlAURA holders to impact governance.

Because of this, the rewards auraBAL stakers received became more valuable.

auraBAL not only helps Meditators gain exposure to the Balancer ecosystem, it also provides boosted rewards, helps LPs maintain liquidity, all while using the staked veBAL for more partnerships into the Balancer ecosystem.

So when the auraBAL Wrapper Creation proposal (AIP-21) recently passed voting, there has unsurprisingly been a significant number of auraBAL mints occurring since then.

One Meditator had apparently minted over 33k auraBAL in one transaction, and Aura Finance has since reported that more than 100K auraBAL has been minted since February.

More than 100,000 auraBAL has been minted since February!

— Aura (@AuraFinance) March 13, 2023

Mint veBAL’s most liquid staking derivative at https://t.co/tbT1P25jDJ. pic.twitter.com/WKejVb59WY

Hopeful that there will be continued growth on this front as Meditators are expectantly waiting for the auraBAL compounder wrapper to go live!

Balancer And Aura's Cross-Chain Era

We are excited to support @BuildOnBase, @Coinbase’s newly created Layer 2 scaling solution 🔵

— Balancer (@Balancer) February 23, 2023

Through @AaveAave and @eulerfinance, we're ready to bring Balancer Boosted Pool technology to Base 💥https://t.co/lbi95SEkrY

This announcement particularly stems from Balancer's announcement in supporting Coinbase's newly created L2 scaling solution, Build On Base.

With such announcement, Balancer plans on providing gauge support on Arbitrum, Avalanche, Optimism and zkSync in the pipeline. It will only be a mater of time before other protocols and LPs take notice.

But what does that mean for Aura? It means more cost-effective methods for LSD partners to utilize Aura to amplify their presence cross-chain.

But don't take our word for it, Aura Finance explains this well in their recent Balancer deep dive thread

Balancer & Aura’s cross-chain era is coming.

— Aura (@AuraFinance) March 10, 2023

Over the course of the next several months, Balancer plans on rolling out its DEX on major blockchains.

Let’s look at what this means for the ecosystem 🧵 pic.twitter.com/2wpKEdOiXE

OHM's 100K Voting Incentives... More To Come?

$100k of voting incentives have been provided by @OlympusDAO this round!

— Aura (@AuraFinance) March 7, 2023

Join us at https://t.co/tbT1P25jDJ. pic.twitter.com/fqmFaePi9Y

Notably, in the Gauge Weight for Week of 2nd March 2023, Olympus swoops in before the voting cycle closes and provides a 100K voting incentive for vlAURA holders.

Meditators are hopeful for more vlAURA voting incentives, as one Meditator recently found on the OlympusDAO forums that "The treasury team plans to have an OIP up in short order on Aura strategy beyond the $1M approved to date."

Interesting.

Synapse and Redacted Cartel Partnership

1/ Excited to Announce the launch of a new SYN/ETH pool on @AuraFinance with help from @redactedcartel that will improve capital efficiency around the SYN/ETH pair. pic.twitter.com/wC9sXWFAxs

— Synapse Protocol (@SynapseProtocol) March 6, 2023

Synapse Protocol, with the help of Redacted Cartel, plans to launch of a new SYN/ETH pool on Aura Finance that will improve capital efficiency around the SYN/ETH pair.

By migrating liquidity to Balancer & migrating incentives to Hidden Hand vs. direct emissions, Synapse DAO can deepen liquidity further.

The first phase will reallocate 15,000 SYN a week, or a quarter of the existing incentives, to vlAURA Hidden Hand incentives, for one gauge voting cycle (two weeks).

The second phase will reallocate 25,000 SYN a week, or 45% of the voting incentives, to vlAURA Hidden Hand incentives, the next voting cycle. On the final phase, Synapse DAO will allocate 35,000 SYN a week to vlAURA voting incentives.

This will then end the Sushiswap migration and Sushi incentives. Read more about its proposal here.

Aside from the updates above, a lot of tweets covered in this section are been focused on Aura's ongoing partnerships and developments.

Our top Tweet of the week comes from @TechFlowPost which translated Aura Finance's LSD Narrative thread into Chinese, resulting in hundreds of retweets and likes, positioning Aura Finance as a strong "winner" in the LSD Shanghai update.

Interestingly, Aura would then create two new language-focused Twitter channels, one for Chinese Meditators (@AuraFinanceCN) and another for Korean Meditators (@AuraFinanceKR)

Hope to see more global Meditators as Aura expands its global reach!

LSD,我们认为是 2023 全年最核心的叙事,一个简单的比方,把 ETH 看作是加密世界的美元,那么stETH就是刚性兑付且自带收益率的美元国债,赛道空间广阔。

— 深潮TechFlow(420,69) (@TechFlowPost) February 28, 2023

LSD 初心是解放流动性,但如今收益率逐渐成了竞争焦点,各种衍生套娃开始出现,我们将介绍三个建立在LSD资产上的DeFi协议。 $YFI @Pendle $AURA pic.twitter.com/P2oxfMJyue

As for StaFi Protocol, we're pleased to see its Balancer and Aura pools doing well.

3️⃣ Our @Balancer pool has been launched, with TVL rising from $460k to $3.2M.

— StaFi | We're Hiring (@StaFi_Protocol) March 13, 2023

4️⃣ The Aura Pool is now live for rETH/Eth, offering up to 40%+ APR. @AuraFinance will launch on L2 protocols with StaFi as first partner, enabling effortless rToken LSDs launch on #Polygon. 🚀

Meanwhile, BiLira tweets in Turkish, promoting their Balancer TRYB/USDC pool.

📢 Balancer TRYB - USDC havuzuna katılarak aldığınız LP token'ları @AuraFinance üzerinde kilitleyebilir, hem $AURA hem $BAL emisyonu kazanabilirsiniz.

— BiLira (@BiLira_Official) March 14, 2023

🟦 Balancer (#DeFi) hakkında detaylı bilgi için: https://t.co/QYXKWTvGMb

🟪 Aura: https://t.co/hzoFIRzKkc pic.twitter.com/hnnNFC8a3r

Gearbox Protocol teases CT with its v3, hinting at Balancer and Aura integrations (but not dropping too much alpha yet...)

The wait is over... The next step to become the base layer of Leverage in DeFi, the next step to Redefine Lending & Leverage. Gearbox V3 ⚙️🧰@Balancer and @AuraFinance integrations, Tokenomics, Alpha Lend Pools with higher APYs, L2 capability and more: https://t.co/B2zIM2YXWm

— Gearbox Protocol ⚙️🧰 (@GearboxProtocol) March 13, 2023

Karpatkey, a DAO treasury manager run by some Aura-aligned partners, recently began managing the ENS Endowment. This includes some deployment of ETH to Aura strategies.

EP 3.4 to fund the first tranche of the ENS DAO Endowment with 16,000 ETH has passed!

— ensdao.eth (@ENS_DAO) March 5, 2023

This marks the culmination of one year of discussions, refinements, & votes led by Meta-Gov Stewards @nicksdjohnson @Coltron_eth @Sim_Pop @katherineykwu@karpatkey will manage the Endowment pic.twitter.com/i62dPw45Us

However @Wartull plans on accomplishing this, both Meditators and OHMies can't wait for the results!

Hol'up,

— Wartull (@WartuII) March 14, 2023

You are saying that Olympus is going to earn $5.3m on its own LP in @AuraFinance ? pic.twitter.com/AbgZwk7QK8

@sagattya, tweeting in Japanese, feels bullish about the 106%APR they're receiving from Balancer's USDR/USDC pool, as well as the other stablecoin yield.

ステーブルの利回りが急上昇中

— さがっちゃ (@sagattya_) March 13, 2023

DeFi市場は最高にウマい状況となっています

一例ですが@AuraFinance

USDR/USDC APR106% $1.13m@ThenaFi_

USD+/CUSD APR86% $556k@VelodromeFi

USD+/DOLA APR65% $2.3m@solidlizardfi

Gamma/USD+ APR135% $550k@SolidlyDEX

USDC/DEI APR83% $600k pic.twitter.com/xqMGpzkEru

Last but not least, we're including @SmallCapScientist in our list of tweets, because we're all wishing for another new AURA ATH each day.

$AURA is still being a total chad…

— Small Cap Scientist 👨🔬🧪🥼 (@SmallCapScience) February 28, 2023

When new $AURA ATH? https://t.co/yCYy93Ctfg

YouTube

Aura is truly going global with two new videos in Chinese and Polish respectively.

A video in Chinese asks the important question: Will Aura Finance be the biggest winner of the Shanghai Upgrade?

Meanwhile, another important question asked in the Polish video: Will Aura Finance make 1000%?

Only time will tell...

Dune Dashboards and Analytics

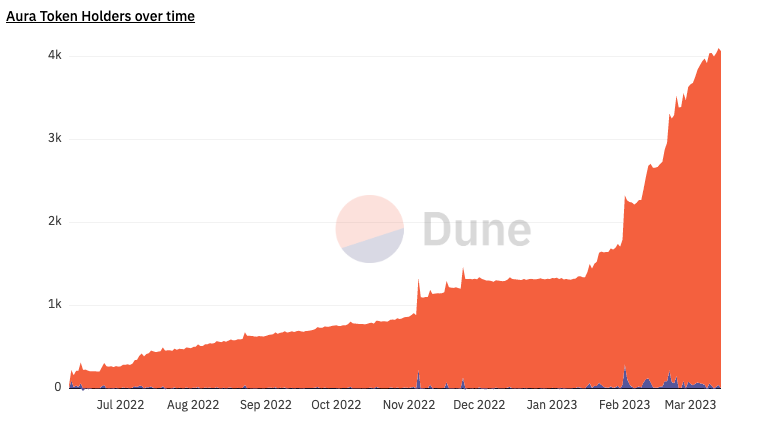

Growth of Aura Token Holders

While it is optimistic to want growth in every protocol, Meditators will be pleased to know that Aura has grown quite rapidly in the last month, reaching to around 4K in Aura token holders early March.

We can only hope that number would keep on scaling, especially during its cross-chain era.

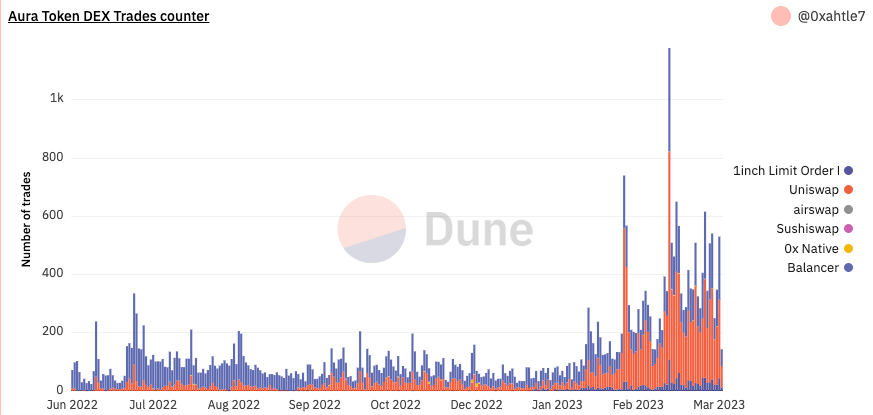

Aura DEX Trades

As for its existing DEX trades, Aura has notably been trading mostly on Balancer and Uniswap, with 1inch gaining some volume in the last few months of 2023.

Eco-system Governance

To get the latest on Aura governance updates head over to the Aura Discord and be sure to follow Aura Finance on twitter.

Disclaimer

The Chakra Alignment series is not official Aura correspondence and is written by community members.